Table of Contents

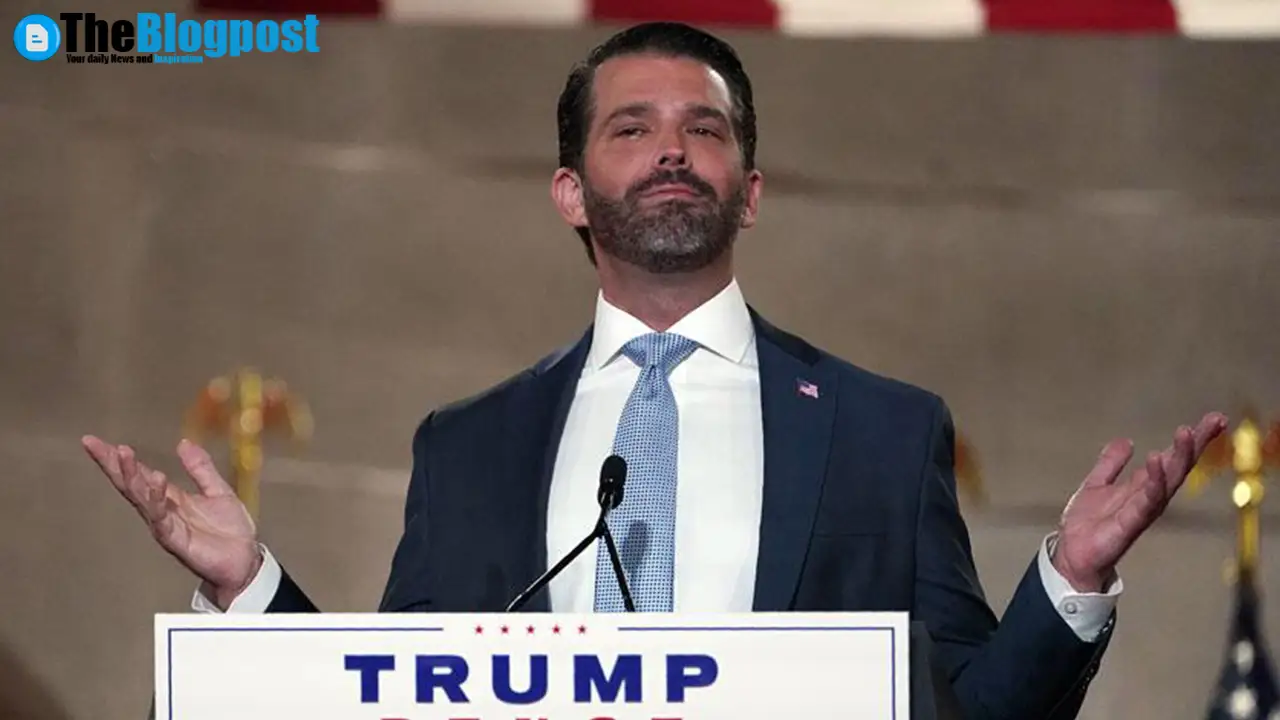

ToggleTrump Jr. Says There’s No Conflict: “Dad’s Not Checking Blockchain Ledgers.” What It Means for Crypto, Policy, and Markets

At TOKEN2049 Singapore, Donald Trump Jr. dismissed questions about potential conflicts of interest linked to World Liberty Financial (WLF) and reiterated that the president “isn’t checking blockchain ledgers” to see who bought what. The remarks, circulated widely in business media, arrive as WLF builds out a stablecoin and card stack—and as the broader crypto market watches for regulatory and political signals that could reshape capital flows.

CNBC — “Trump Jr. dismisses crypto conflicts of interest, says dad’s not checking blockchain ledgers”

. (Robust context from Reuters and the Financial Times is incorporated below.)

Bottom Line Up Front

The public position from Trump Jr. is clear: critics are “over-reading” political proximity; WLF is pitching itself as a private venture; and the White House, he says, is not peering into on-chain ledgers to favor token holders. For crypto investors, the market question is not the quip itself—it is what comes next: how the venture executes stablecoin, debit-card, and token plans; how regulators respond; and whether institutional partners push for additional disclosures.

Meanwhile, stablecoins and settlement rails tied to the dollar are gaining strategic importance, which is why statements from high-profile figures at a global event matter for crypto sentiment and for policy expectations.

What Was Actually Said—and Why the Wording Matters

The CNBC framing—“not checking blockchain ledgers”—lands as a simple denial, yet it also functions as a line in the sand: operational independence between a private crypto venture and public office. The phrase is specific enough to address ledger scrutiny, but broad enough to leave governance, disclosures, and compliance questions to the company’s formal processes. That ambiguity is typical in fast-evolving crypto communications where legal, political, and technical layers collide.

Crucially, WLF’s public roadmap includes a debit card and the USD1 stablecoin—components that bridge on-chain assets with real-world spending. Those features elevate scrutiny because they anchor crypto activity to consumer protection, KYC/AML regimes, and payments regulations across multiple jurisdictions.

Conflict-of-Interest Heat Map: Where Concerns Tend to Cluster

- Policy spillover: If a private crypto project benefits from regulatory moves, observers will ask whether policymaking and commercial interests are adequately separated.

- Counterparty optics: Banking, card networks, and settlement partners might demand extra transparency before attaching their brands to a politically adjacent crypto product.

- Stablecoin reserve discipline: Dollar-pegged coins draw questions about custodians, attestations, and redemption terms—especially in politically charged crypto contexts.

Heat-map areas are standard across fintech launches; political proximity simply intensifies them.

Context From the Roadmap: Debit Cards, Stablecoin USD1, and Real-World Rails

Reuters reports that WLF intends to roll out a branded debit card and to expand its tokenization agenda, while also pursuing a dollar-pegged coin (USD1). If executed, those moves position the company in the day-to-day payments layer rather than solely in speculation. For crypto markets, that migration toward utility is the point: the more people can spend coins directly, the less friction separates blockchain value from retail life.

Moreover, the stablecoin thesis goes beyond convenience. The FT captured a claim that dollar-backed stablecoins can support USD demand and, by extension, Treasury markets. That narrative—controversial but influential keeps crypto squarely inside macroeconomic debates rather than on the margins.

Three Scenarios Investors Should Model

- Status quo, elevated scrutiny: WLF ships products; regulators watch; partners seek robust compliance. Crypto sentiment tracks delivery milestones.

- Policy friction: A regulatory flashpoint (reserves, marketing, or disclosures) slows rollout. Crypto pricing reacts to perceived favoritism or clampdowns.

- Institutional embrace: Banking and fintech pipelines deepen; USD1 gains volume; the card reaches scale. Crypto narratives shift to payments and settlement efficiency.

Risk Register: What Could Go Wrong (and How Teams Usually Mitigate)

- Perception risk: Even if governance is sound, a politically exposed crypto brand carries headline volatility. Mitigation: independent boards, third-party attestation, and clear conflict policies.

- Execution risk: Card programs require flawless KYC, chargeback handling, and fraud controls—weak links here can erode trust in both payments and crypto stacks.

- Liquidity risk: Stablecoin pegs can wobble during stress. Mitigation: conservative reserves, robust redemptions, and transparent disclosures.

- Regulatory divergence: Multi-country launches face patchwork rules; crypto teams often stagger deployments to stay compliant.

Why the Phrase “Not Checking Ledgers” Resonates in Crypto

On-chain transparency is a double-edged sword: it lets anyone audit flows, yet it also enables narratives that cherry-pick addresses without context. In crypto, a public denial about peeking at specific buyers is less about technical ability and more about signaling institutional distance. That is why the soundbite traveled: it simplifies a complex governance question into a memorable line, which then shapes how mainstream audiences perceive crypto ethics.

Market Structure Angle: If Utility Grows, Where Does Value Accrue?

If card-based spending and stablecoin rails scale, value could accrue to multiple layers: wallets, compliance APIs, stablecoin treasuries, and the networks carrying transactions. For crypto traders, this diffusion matters; it changes how narratives form and how treasuries evaluate partnerships with issuers. Consequently, coins tied to low-cost settlement, identity primitives, or off-ramp liquidity may see renewed interest when headlines like these hit.

How to Read Politically Adjacent Crypto News Without Getting Lost

- Trace the quotes: Prefer primary interviews or verified clips; note what is said—and what is not. (Here, the denial is narrow but clear.)

- Anchor to filings and roadmaps: Debit cards and stablecoins live in regulated terrain; check timing, partners, and reserve policies.

- Separate price from plumbing: Short-term crypto price reactions do not validate the underlying business case.

Source Pack (for context)

- Reuters: WLF debit card plans and spending use cases.

- Financial Times: Stablecoins, USD demand, and macro framing.

- Reuters (earlier): USD1 stablecoin launch details and reserve posture.

- CNBC framing via social clip: “Dad’s not checking blockchain ledgers.”

The CNBC article itself is linked at top . Additional outlets confirm surrounding facts and roadmap items.

Stakeholder Impact: Users, Builders, and Institutions

Everyday users

If the card launches smoothly, spending crypto at ordinary merchants could feel less exotic. However, users should still expect KYC, fees, and occasional friction during early rollout. Consumer protection rules do not vanish simply because a wallet connects to a card.

Builders and startups

A high-profile venture can be a rising tide or a distraction. Smart teams will leverage the attention to showcase infrastructure that solves real problems: faster settlements, cheaper remittances, and programmable compliance for crypto transactions at scale.

Institutions and banks

Banks considering stablecoin integrations will examine reserves, redemption windows, and legal opinions. They will also watch how politically adjacent crypto brands handle media cycles; reputation risk matters in procurement committees.

FAQ: The Noisiest Questions, Answered Briefly

Is there confirmed government involvement in WLF operations?

No. Public comments state the opposite, and coverage frames the venture as private. }

Does a denial settle the conflict debate?

Not entirely. Best practice in crypto is governance transparency plus third-party attestations—both prove distance better than quotes alone.

Is the stablecoin angle real or just PR?

Reuters documented USD1 plans months earlier; execution details still matter.

Editorial View: Policy Theater vs. Product Reality

The line “not checking blockchain ledgers” is political theater with a pragmatic edge. It tries to cap a narrative before it spirals, which is understandable in a cycle where every crypto launch invites macro-level commentary. Nevertheless, product reality will decide the arc: reserve quality, compliance design, card performance, and user experience.

If those fundamentals are strong, attention will shift from who said what to whether people actually prefer these rails for everyday payments. If they are weak, the political noise will merely accelerate skepticism about crypto utility. Either way, execution writes the final headline.

Further reading

If you want a practitioner’s lens on market phases and positioning across crypto cycles, this longform explainer pairs well with today’s news:

Crypto Market Rotation Strategy.

It covers risk cadence, sector leadership, and portfolio rules for volatile crypto tapes.

Leave a Reply